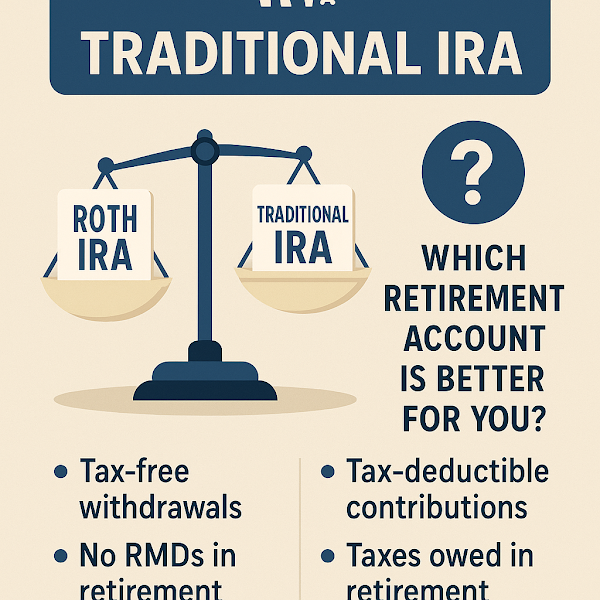

Roth IRA vs Traditional IRA: Which Retirement Account Is Better for You?

Roth IRA vs Traditional IRA: Which Retirement Account Is Better for You?

Description: Choosing between a Roth IRA and a Traditional IRA? Learn the key differences in tax advantages, income limits, withdrawal rules, and which one suits your financial future best. Retirement planning starts here.

1. Understanding the Basics: What Is an IRA?

An IRA, or Individual Retirement Account, is a tax-advantaged savings vehicle designed to help Americans invest for retirement. There are two primary types: Traditional IRA and Roth IRA. Both offer tax benefits—but in very different ways.

Think of a Traditional IRA as a “pay-later” account: you contribute pre-tax income now, then pay taxes on withdrawals in retirement. A Roth IRA is a “pay-now” option: you contribute after-tax income now, but withdrawals later are tax-free.

Each has pros and cons, and the best choice depends on your current income, tax bracket, and retirement expectations.

2. Tax Treatment: Pay Now or Later?

This is the defining difference between Roth and Traditional IRAs:

- Traditional IRA: Contributions are tax-deductible (if eligible), and your investments grow tax-deferred. You’ll pay ordinary income tax on withdrawals.

- Roth IRA: Contributions are made with after-tax dollars. You won’t get a tax break now—but your withdrawals, including gains, are tax-free in retirement.

If you expect your retirement tax rate to be lower than it is today, a Traditional IRA might be the better bet. But if you expect to pay higher taxes later, or you want tax-free income in retirement, go with a Roth.

3. Income Limits and Eligibility

Here’s where Roth and Traditional IRAs diverge significantly:

- Roth IRA: In 2025, eligibility begins to phase out at $146,000 for single filers and $230,000 for married couples filing jointly.

- Traditional IRA: Anyone can contribute, but the tax deduction may be limited if you or your spouse is covered by a workplace plan and your income exceeds certain thresholds.

In both cases, the annual contribution limit is $6,500 ($7,500 if age 50 or older) as of 2025. Many people don’t realize this—but you can contribute to both types, just not more than the total limit.

4. Withdrawal Rules and Required Minimum Distributions

Each account comes with its own rules for accessing funds:

- Traditional IRA: Withdrawals before age 59½ are penalized (10%) and taxed. Required Minimum Distributions (RMDs) start at age 73.

- Roth IRA: Contributions can be withdrawn at any time, tax- and penalty-free. Earnings are tax-free after age 59½, provided the account is 5 years old. No RMDs during the owner’s lifetime.

That “no RMDs” feature makes Roth IRAs a favorite for estate planning and long-term flexibility.

5. Which IRA Works Best for Different Life Stages?

The better account often depends on where you are in life:

- Young Professionals: Roth IRA. You're likely in a lower tax bracket now, so paying taxes up front makes sense. Plus, decades of tax-free growth is a huge benefit.

- Mid-Career Earners: Consider a mix. If your income is rising and you anticipate higher taxes later, a Roth can hedge against future tax hikes while still contributing to a Traditional IRA for deductions.

- High-Income Individuals: Traditional IRA (non-deductible) may be used for backdoor Roth conversions if you’re over the Roth income limit.

- Approaching Retirement: Traditional IRAs may offer upfront deductions that reduce your taxable income, which can help now if you’re nearing retirement age.

I personally started with a Roth in my 20s, then added a Traditional IRA in my 40s to take advantage of deductions. This diversified tax approach gives me more control in retirement.

6. Final Comparison and Choosing the Right One

Here’s a quick summary:

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax on Contributions | Pre-tax (deductible) | After-tax |

| Tax on Withdrawals | Taxed as income | Tax-free (qualified) |

| RMDs Required? | Yes (starting at age 73) | No |

| Income Limits to Contribute | No (but deductions may phase out) | Yes (phases out at $146k–$230k) |

| Best For | Higher earners needing deductions now | Younger workers or long-term planners |

The right IRA depends on your current tax bracket, future expectations, and long-term goals. You can’t go wrong saving for retirement—but choosing the right tool can make a huge difference.

The average American retires with less than $100,000 saved, yet experts recommend at least 8–10 times your annual income. Choosing the right IRA—and contributing consistently—can supercharge your nest egg. And thanks to compound growth, the earlier you start, the easier it gets. Even a $200/month contribution to a Roth IRA starting at age 25 can grow to over $400,000 by retirement. That’s the power of time and tax advantages combined.

1. Can I have both a Roth IRA and a Traditional IRA?

Yes, you can contribute to both in the same year as long as your total contributions don’t exceed the IRS limit ($6,500 or $7,500 if 50+ in 2025). Strategic split contributions can diversify your retirement tax exposure.

2. What if my income exceeds Roth IRA limits?

You can still contribute to a Traditional IRA and then do a backdoor Roth conversion. This is a legal workaround for high earners to benefit from Roth advantages despite income caps.

3. Which IRA is better for estate planning?

Roth IRAs are often favored because they don’t have required minimum distributions (RMDs), allowing the account to grow longer. Beneficiaries can also withdraw tax-free under current rules.

4. Are IRA contributions tax-deductible?

Traditional IRA contributions may be deductible depending on income and employer retirement plan coverage. Roth IRA contributions are not deductible, but provide tax-free withdrawals later.

5. What’s the deadline to contribute to an IRA?

You have until the tax filing deadline—typically April 15 of the following year—to make a contribution for the previous tax year. This gives you flexibility in your tax planning and investment strategy.